As part of the EU’s Omnibus I simplification package, first proposed by the European Commission in February 2025 to reduce administrative burdens, the European Parliament and Council agreed to significantly narrow the scope of the Corporate Sustainability Reporting Directive (CSRD).

On 16 December 2025, the European Parliament formally approved these changes, limiting CSRD to companies with at least 1,000 employees and €450 million in annual turnover. This revision removes around 90% of previously expected companies from the obligation to report, with the amendments now awaiting publication in the EU Official Journal before entering into force.

Scope of application

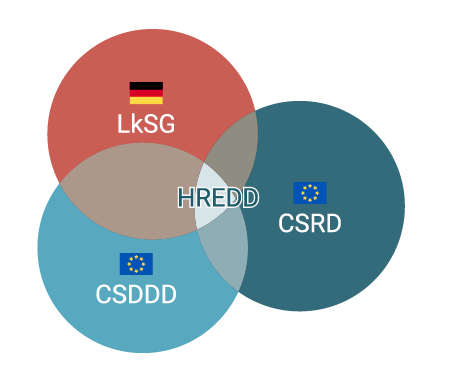

HREDD – the overlap of all three legislations

Even though the CSRD is a reporting framework, elements of a human rights and environmental due diligence are integrated at the core. By focusing on HREDD, synergies can be used to comply with requirements of all three legislations.

“Do no harm”: Assess human rights and environmental risks (negative impacts) along entire value chain (excluding downstream for the LkSG); engage with stakeholders; implement preventative measures and remediation, and report on developments.

“Do good”: Understand and assess positive social & environmental impacts along entire value chain incl. downstream (specific for the CSRD).

Read our blog post here to compare the CSRD and LkSG reporting requirements, and watch our webinar on connecting the CSDDD & CSRD.

Scope of obligations

To understand what needs to be considered for each assessment of potential impacts, risks and opportunities, the scope and requirements of the frameworks needs to be considered.

CSRD: What should be reported

The sustainabilty statement should take the same scope of reporting as the undertaking’s financial statements. However, this should be extended to include information on the material impacts, risks and opportunities connected with the undertaking through its own operations, and through its direct and indirect business relationships in the upstream and downstream value chain. The report should cover information on the company’s material impacts, risks and opportunities, in accordance with specific requirements in the ESRS

Reporting Structure

The ESRS provides a comprehensive reporting structure on sustainability matters to ensure companies report consistently across social, environmental, and governance topics.

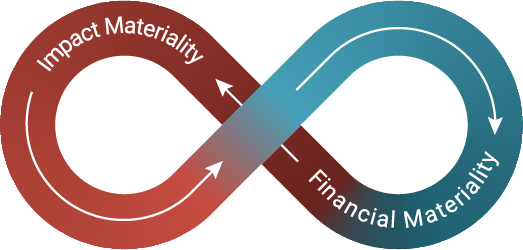

Double materiality assessment

For companies subject to the CSRD, conducting a double materiality assessment is mandatory. This process enables them to identify which sustainability issues are material and must be included in their reporting.

Double materiality has two dimensions: impact materiality and financial materiality. Impact materiality and financial materiality assessments are inter-related and interdependent. A topic is material either from the impact perspective, the financial perspective or both.

- A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the

environment over the short, medium- and long-term time horizons. - Impacts include those connected with the undertaking’s own operations and upstream and downstream value chain, including through its products and services, as well as through its business relationships.

- When assessing actual negative impacts, materiality is based on the severity of the impact, while for potential negative impacts it is based on the severity and likelihood of the impact.

- For positive impacts, materiality is based on the scale and scope of the impact for actual impacts; and the scale, scope and likelihood of the impact for potential impacts.

- A sustainability matter is material from a financial perspective if it triggers or could reasonably be expected to trigger material financial effects on the undertaking, over the short, medium- or long-term.

- The scope of financial materiality is an expansion of the scope of materiality used in the process of determining which information should be included in the undertaking’s

financial statements. - The materiality of risks and opportunities is assessed based on a combination of the likelihood of occurrence and the potential magnitude of the financial effects.

We recognise the strong link between strategy and reporting, especially in the evolving landscape of sustainability regulations. As companies navigate the Corporate Sustainability Reporting Directive (CSRD), aligning sustainability objectives with business strategies is essential for long-term success.

We are here to support companies in advancing their strategic approach to meet CSRD requirements, ensuring that reporting reflects a cohesive and forward-thinking strategy.

Our services include:

Double materiality assessment

ESRS gap assessment

Roadmap and implementing actions

Streamline strategies

Contact us

Contact us